Price Calculator for Bond Futures (Cost of Carry Model)

(For calculating price of bond futures that has time to maturity less than 180 days) Yield to Price

Price to Yield

% (Annually)

% (Annually)

Days (Maximum 180 days)

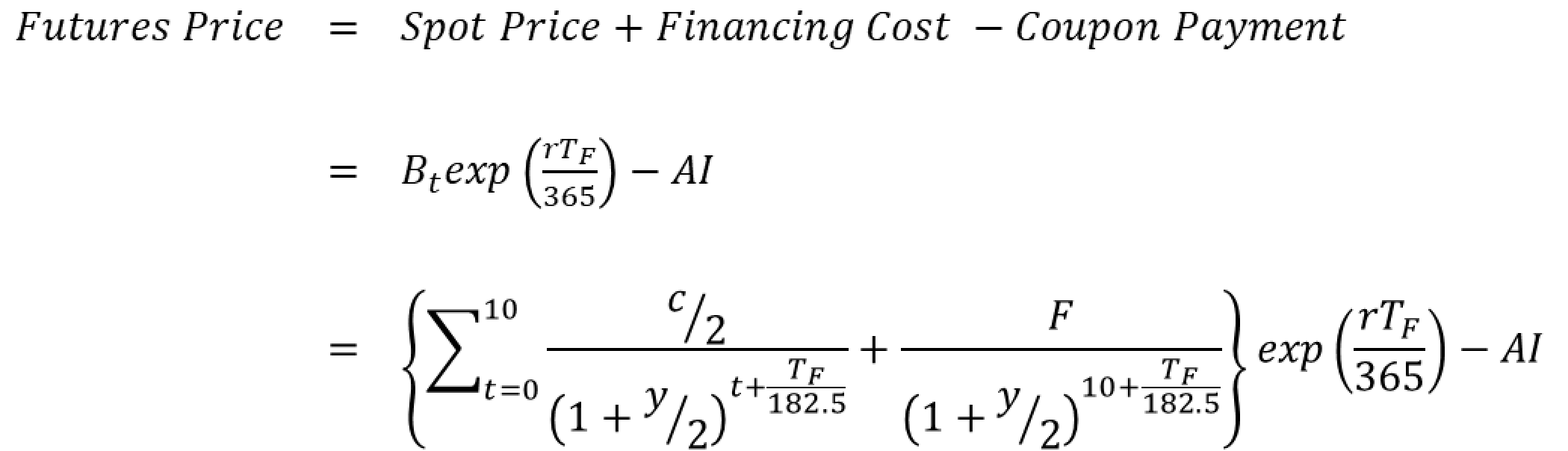

Formula

![bond]()

Example

The bond yield of a 5-year government bond with 3 months left to maturity is at 2.60% (annually). The 3-month interest rate is at 1.68%.

Therefore,

the theorical price of a 5-Year Government Bond Futures with 3 month to maturity is 110.9319

From the above example, y=2.60, r=1.68, TF=90

Variables

Futures Price

is Bond Futures price by Cost of Carry Model

B

t

is bond price that has the same time to marturity

AI

is coupon rate of a bond during the Futures holding period.

r

is Interst Rate (% Annually)

T

f

is Time to maturity (days)

C

is Coupon rate

y

is Discount rate

F

is Bond Face Value